Author: Sylvia Kyriakou;

Source: shafer-motorsports.com

Journal About Auto Insights

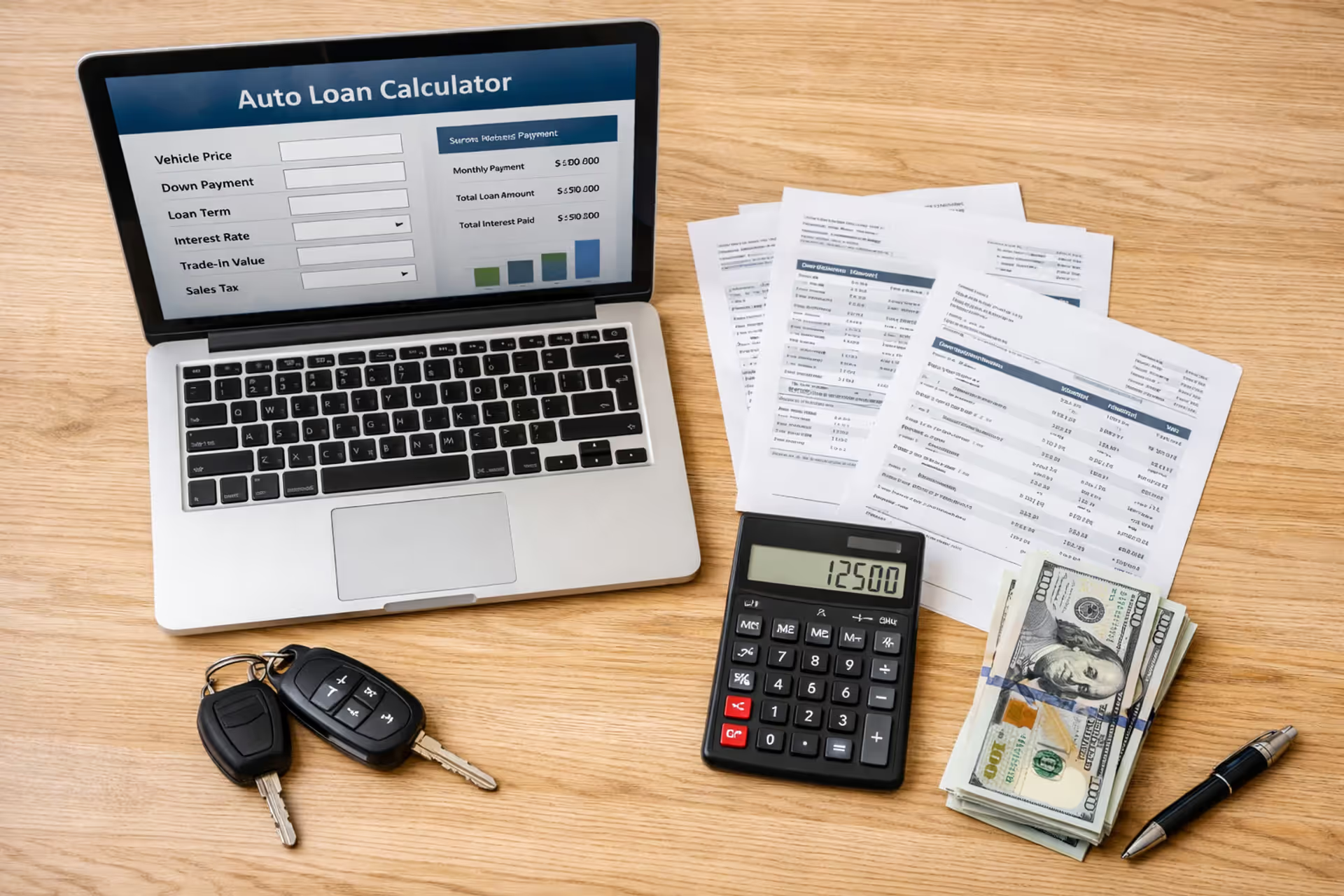

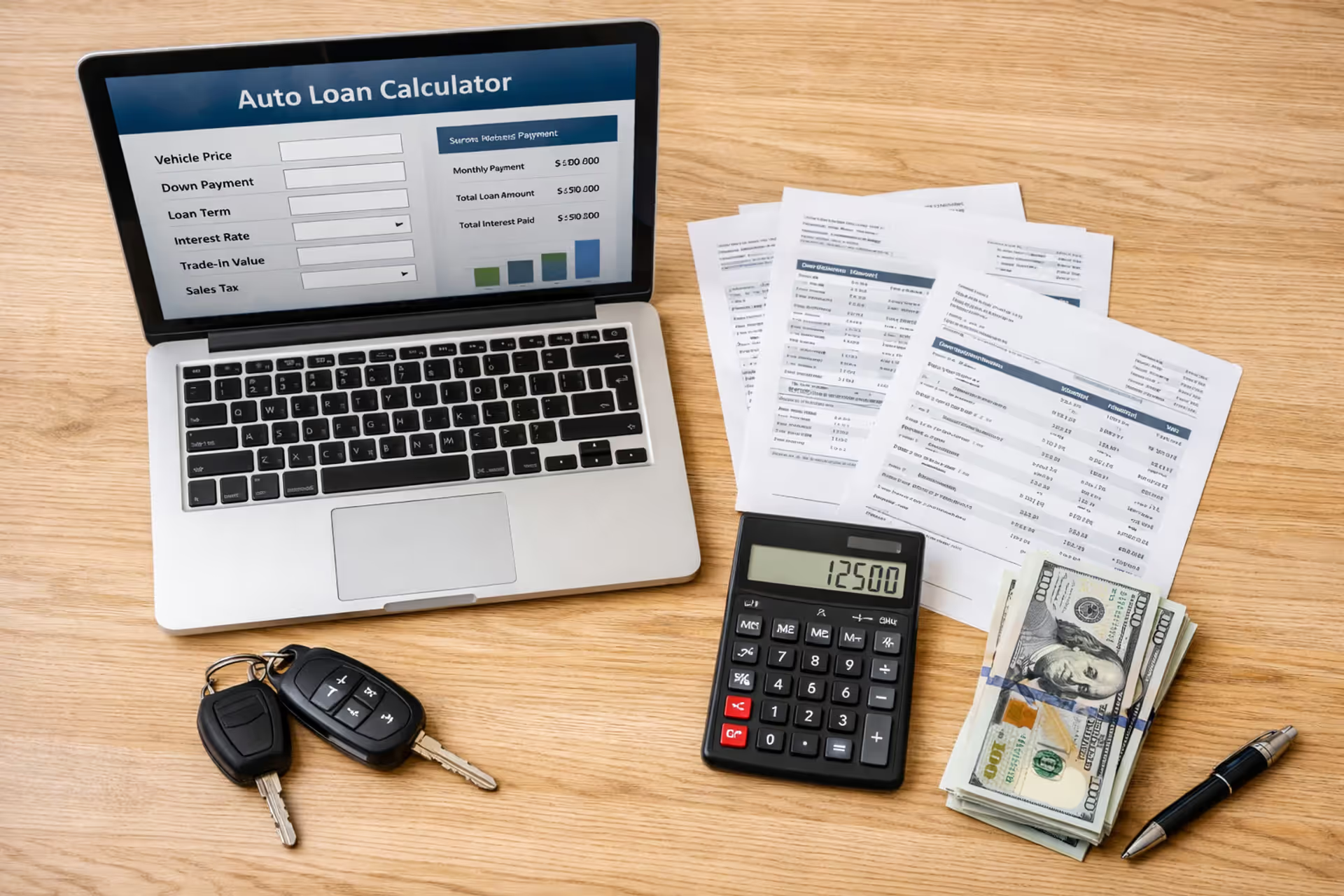

Welcome to Auto Insights — a place where car decisions feel clearer and more confident.

Here, we talk about cars, EVs, and ownership in a practical, approachable way — breaking down complex topics into insights you can actually use. We share guides, comparisons, tools, and real-world tips designed to fit into everyday driving and buying decisions.

You’ll find side-by-side comparisons for auto insurance and loans, easy-to-follow EV buying guides, maintenance advice, accessory reviews, and smart calculators that help you choose what’s right for you — not what’s loudest online. Auto Insights is for people who want to make informed choices without the pressure.

Read more

Top Stories

Read more

Read more

Read more

Read more

Trending

Read more

Read more

Latest articles

Most read

Read more

Read more

In depth

Regular oil changes are essential to keep your car running smoothly and efficiently. Engine oil lubricates the various moving parts within the engine, reducing friction and preventing wear and tear. Without regular oil changes, the oil can become dirty and thick, losing its ability to protect the engine. This can lead to increased friction, overheating, and eventually, engine damage. Keeping up with your car's oil change schedule not only prolongs the life of your engine but also helps maintain optimal fuel efficiency, saving you money in the long run.

Modern engines are precision instruments with thousands of moving parts working in harmony, and engine oil is the lifeblood that keeps everything functioning properly. The oil creates a thin film between metal surfaces, preventing direct contact that would otherwise generate excessive heat and wear. As oil circulates through the engine, it also carries away contaminants, metal particles, and combustion byproducts that could damage engine components. Over time, however, these contaminants accumulate in the oil, reducing its effectiveness and potentially causing harm to your engine.

Skipping oil changes might seem like a way to cut costs, but it often leads to more expensive repairs down the road. When engine oil breaks down, it can cause sludge buildup, which clogs the engine and restricts oil flow. This can result in the engine overheating and critical parts becoming damaged. If left unchecked, it could lead to engine failure, re...

Read more

The content on Auto Insights is provided for general informational and educational purposes only. It is intended to offer guidance on car buying, vehicle ownership, finance, insurance, EVs, maintenance, accessories, reviews, and related topics, and should not be considered professional financial, legal, insurance, mechanical, or investment advice.

All information, tools, calculators, comparisons, and recommendations presented on this website are for general guidance only. Individual financial situations, driving habits, vehicle conditions, insurance policies, and market factors vary, and actual results or costs may differ from estimates provided.

Auto Insights makes no guarantees regarding accuracy, completeness, or current applicability of the information, as automotive markets, regulations, incentives, interest rates, and vehicle specifications may change over time.